The Financial Accountability Regime Bill 2022 (New Bill) has been initiated in Parliament. Because the New Bill has not changed in substance from the Financial Accountability Regime Bill 2021 (Previous Bill), which lapsed when the 2022 federal election was called, it will receive bipartisan support. Subsequently, organisations can be confident that it will become law soon and should begin to prepare.

Background

The new financial accountability regime (FAR) will apply to financial entities in the banking, insurance and superannuation industries. This article aims to recap the critical aspects of the New Bill as it will apply to Registerable Superannuation Entity (RSE) licensees. This article also considers the Exposure Draft Financial Accountability Regime Minister Rules 2022(Minister rules) as they will apply to RSE licensees.

The critical aspects of the FAR have remained unchanged under the New Bill. These include the following:

Persons to whom the financial accountability regime applies

The FAR will apply to “accountable entities” and certain “accountable persons”. These are both defined terms:

- Accountable entities include RSE licensees that are constitutionally covered bodies.

- An accountable person, concerning an RSE licensee, means:

(a) a person who holds a position in the accountable entity or in another body corporate to which the accountable entity is a connected entity

(b) because of that position, the person has actual or practical senior executive responsibility for management or control of the accountable entity or management or control of a significant part or aspect of the operations of the accountable entity or the accountable entity’s relevant group.

- The New Bill defines “relevant group” as the accountable entity and its significant related entities. Whether an entity is a “significant related entity” often involves looking at whether the entity is an “associated entity” under the Corporations Act and whether it has or is likely to have a “material and substantial” effect on an accountable entity or its business or activities.

- We note that the concept of an associated entity is broader than a member of the same corporate group and, in certain cases, may capture, for instance, a promoter of a superannuation fund.

- An individual is also an accountable person of an RSE licensee if: (a) the person holds a position in, or relating to, the accountable entity; and (b) because of that position has a responsibility prescribed in the Minister’s rules.

Core obligations of the Financial Accountability Regime

The FAR will broadly impose the following four core obligations concerning financial entities operating in the banking, insurance and superannuation industries and their senior executive management. Each set comprises a detailed “checklist” of obligations. Accordingly, we provide the following high-level overview of them.

- The Accountability Obligations are intended to encourage acting with honesty, integrity, due care, skill and diligence, as well as dealing with ASIC and APRA (together, the Regulator) in an open, constructive and cooperative way. They complement and support other legislative obligations, such as the general obligations of a financial services licensee under section 912A of the Corporations Act and the covenants set out in section 52 of the SIS Act. Having well-documented and appropriate governance, control and risk management procedures and protocols will enable compliance with these obligations.

- The Key Personnel Obligations are intended to ensure that responsibilities covering all aspects of the operations of the accountable entity and its significant related entities are appropriately allocated to accountable persons. Notably, accountable persons must be registered with the Regulator and not disqualified.

- The Deferred Remuneration Obligations require that at least 40% of an accountable person’s variable remuneration is deferred for at least the “minimum deferral period” (generally, a period of 4 years) with some narrow exceptions. Accordingly, remuneration policies must also comply with the deferred remuneration obligations.

- The Notification Obligations consist of “core” and “enhanced” notification obligations.

- Core notification obligations will apply to all accountable entities. Broadly, they require accountable entities to notify the Regulator within 30 days if certain events occur. Such as, if a person ceases to be an accountable person, an accountable person is dismissed or suspended due to failure to comply with accountability obligations; an accountable person’s variable remuneration is reduced because of a failure to comply with accountability obligations.

- Enhanced notification obligations, in contrast, only apply to accountable entities which meet a threshold prescribed by the Minister’s rules. Enhanced notification obligations require an accountable entity to give the Regulator an accountability statement and an accountability map and inform the Regulator of any changes to these documents. Accountability is a comprehensive statement of the relevant accountable person’s responsibilities. An accountability map identifies each accountable person and their reporting lines and lines of responsibility.

Consequences of non-compliance with Financial Accountability Regime

An accountable entity is liable to a civil penalty for non-compliance with an obligation under the FAR. Further, there will be civil penalties for ancillary contraventions (e.g. attempting, aiding or abetting an infringement).

Administration

The FAR will be administered by APRA and ASIC jointly.

What’s new?

The only difference between the Previous Bill and New Bill relates to when an entity commences being an accountable entity. In the case of an RSE licensee, a constitutionally covered body, it will be an accountable entity from the day which falls 18 months after the commencement of the Act.

When will the Financial Accountability Regime Bill commence?

The FAR will commence the day after the Act receives the Royal Assent. However, the FAR will have a staggered application. As noted above, an existing RSE licensee, a constitutionally covered body, will be an accountable entity from the day which falls 18 months after the commencement of the Act.

Minister rules

The draft Minister rules were released on 12 September 2022.

The Minister’s rules aim to prescribe certain matters for the Act. The following prescribed matters affect RSE licensees:

- Prescribed responsibilities or positions that cause a person to be an accountable person. The Minister’s rules prescribe being a director of the RSE licensee. The Minister’s rules also prescribe a range of senior executive responsibilities, including managing the RSE licensee’s business activities, financial resources, operations, risk controls, internal audit function, compliance function, human resource function, anti-money laundering function or dispute resolution function. Further, the Minister’s rules prescribe senior executive responsibility for managing the RSE licensee’s member administration operations, investment function, financial advice service or insurance offerings.

- Prescribed enhanced notification threshold for the Notification Obligations. Under the Minister’s rules, the threshold at which the enhanced notification obligations apply is if the RSE licensee’s total asset size equals or exceeds $10 billion at the start of the financial year. The Minister’s rules also prescribe the meaning of total asset size.

What do RSE licensees need to do to comply with the Financial Accountability Regime Bill?

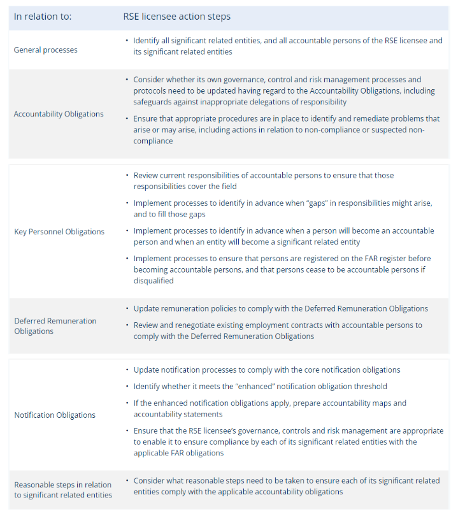

RSE licensees must undertake some initial work to comply with the FAR. Below, we set out a non-exhaustive checklist of steps that we view as important:

Vogue Advisory Group – we are here to help.

Professional financial advice can make a difference if you are in the initial stages of your working life, planning to expand your family, or are well-established and looking towards retirement. If you require financial advice, please get in touch with us, and one of our experienced financial advisors will assist you.